| This is a summary of an interesting idea from Charley Kyd’s substack. Food for thought. |

Here is a summary of the main points:

- The article argues that the traditional definition of a recession, based on two consecutive quarters of negative GDP growth, is outdated and misleading.

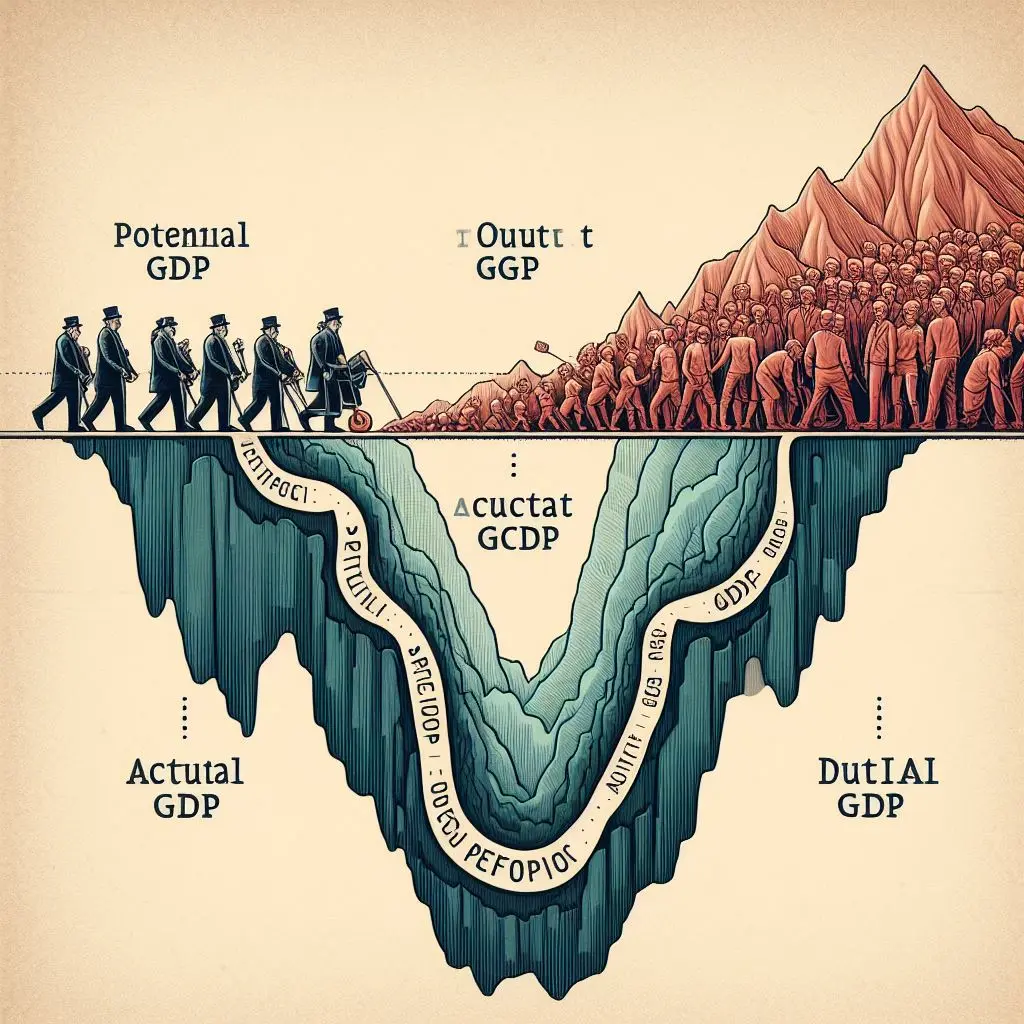

- The author proposes a new definition of a recession, based on the concept of “potential GDP”, which is the level of output that the economy could produce if all resources were fully employed.

- The author claims that potential GDP has been growing faster than actual GDP since the 2008 financial crisis, creating a persistent output gap that indicates a prolonged recession.

- The author uses various charts and data sources to illustrate the output gap and its implications for unemployment, inflation, and productivity.

- Kyd concludes that the output gap is a more useful indicator of the state of the economy than the traditional definition of a recession, and that policymakers should focus on closing the gap and restoring potential GDP.